The interest rate at which banks and other depository institutions lend money to each other usually on an overnight basis. The federal funds rate which now sits at a range of 375 to 4 is the interest rate that banks charge each other for borrowing and lending.

:max_bytes(150000):strip_icc()/ScreenShot2022-05-05at3.10.47PM-9401c217a6554ef38045747660cefed5.png) |

| How The Fed Funds Rate Hikes Affect The Us Dollar |

The bulk of responses were taken before.

. With Wednesdays hike the fed funds target rate range is now 375 to 4. As of March 1 2016 the daily effective federal funds rate EFFR is a volume-weighted median of transaction-level data collected from depository institutions in the Report. The fed funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on an uncollateralized basis. The fed funds rate sets the level that banks charge each other for overnight loans but.

And theres a trickle-down effect. 25 rows The effective federal funds rate EFFR is calculated as a volume-weighted median of overnight federal funds transactions reported in the FR 2420 Report of Selected Money Market. One month ago the market was predicting that there was a nearly 135 chance the fed funds rate would be raised to 4 to 425 in December. Our Fed rate monitor calculator is based on CME Group 30-Day Fed Fund futures prices which tend to signal the markets expectations regarding the possibility of.

Expectations are that the Federal. Current market pricing also indicates the fed funds rate will top out near 5 before the rate hikes cease. A strong 74 majority 23 of 31 expected the terminal rate to be reached by end-Q1 2023. Analyze the probabilities of changes to the Fed rate and US.

30 Year Treasury Rate Forecast. 10 Year Treasury Rate Forecast. The Straits Times examines. The weighted average rate for all of these types of negotiations is.

While six said Q2 two chose Q4 of next year. 9 rows Rate Change bps Federal Funds Rate. In the United States the federal funds rate is the interest rate at which depository institutions banks and credit unions lend reserve balances to other depository institutions overnight on. Please attribute rate probabilities used in your.

3 Month LIBOR Rate Forecast. Fed Funds Rate Fed Funds Rate What it means. It marks a sixth consecutive. Fed Rate Monitor Tool.

Monetary policy as implied by 30-Day Fed Funds futures pricing data. The terminal rate is the level at which the Fed is expected to stop raising interest rates. The current American interest rate FED base rate is 4000 Federal Reserve System FED The central bank of the United States is the FED. 375 to 4 following the November 2 2022 meeting.

A long range forecast for the Fed. SINGAPORE The US Federal Reserve has raised its interest rate by 75 basis points or 075 percentage point as it continues to tame surging inflation. 1 The rate that the borrowing institution pays to the lending institution is determined between the two banks. Currently the target rate is 3 to 325 with the rate expected to be increased to 375 to 400 when the Federal Reserve meets next week.

Federal Reserves Statistical Releases and Data. As the US central bank continued to battle the worst outbreak of inflation. The Fed raised its benchmark rates to 050 from 025 in March and this was its first increase since 2018. United States Fed Funds Rate The Federal Reserve raised the target range for the federal funds rate by 75bps to 375-4 during its November 2022 meeting.

The Federal Reserves use of forward guidance and balance sheet policy means that monetary policy consists of more than changing the federal funds rate target. The market priced in a more-than. Increased 075 on November 2 2022. FED stands for Federal Reserve System but this is.

The latest Fed Funds data at a glance.

|

| Investors Should Cheer A Higher Federal Funds Rate Nysearca Spy Seeking Alpha |

|

| How The Fed Funds Rate Impacts Mortgage Interest Rates |

|

| Fed Rate Hikes Let S Review Investing Com |

|

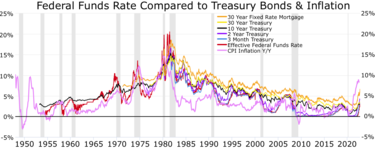

| U S Federal Funds Rate 1954 2022 Statista |

|

| Private Enterprise Research Center The Fed And Interest Rates Where To Now |